Enter The Spirit Wars — Curve Wars All Over Again

The Wars are in full force on Ethereum and Fantom.

Welcome Anon! Today’s article will hurt your head if you’re not a crypto native. It is more curated for the autists. However, it covers an interesting topic nonetheless so go ahead and give it a try. Any questions are welcome in the comment section.

It’s all happening again. The Curve Wars are taking place on Fantom with different parties involved. If you’re not familiar with the Curve Wars, rest assured. I will start by providing you with an overview before we go into the Spirit Wars. For this, you need to know about Curve Finance which is a Decentralized Exchange (DEX), and Automated Market Maker (AMM) that focuses on swaps between stablecoins (which are assets that are pegged — stable assets).

Curve arguably has the best tokenomics in DeFi with their token CRV. This token incentivizes people to yield farm and lock up their token for governance. When you lock up CRV you receive veCRV (vote-escrowed CRV) which is the governance token that is used to vote on proposals and gauges in the curve ecosystem. The functionality of veCRV is central to the Curve Wars so stay with me. The longer you lock up CRV the more veCRV you receive.

Yield Allocation & Bribes

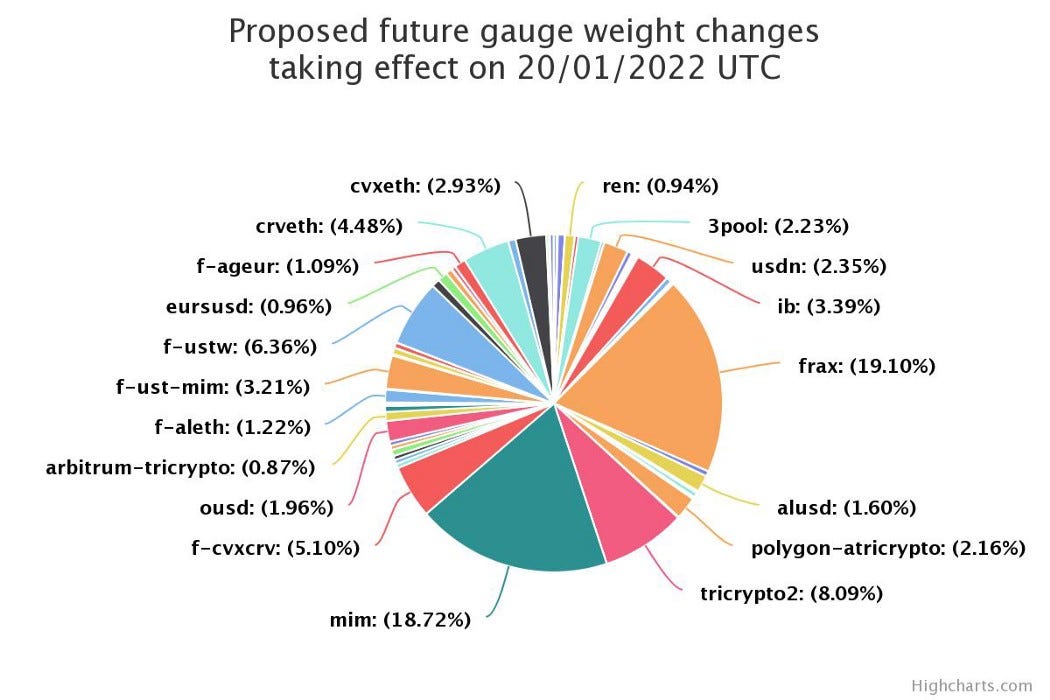

I mentioned that veCRV enables you to vote on gauges. This is fundamental because these gauges decide the amount of CRV rewards that will be allocated to each pool. Basically, it drives yields to the pools with the most votes.

All these gauges are weighted and depending on the allocated votes, the yield gets driven to certain pools. However, as in any war, you have soldiers that fight for the sake of glory and other soldiers that simply fight for money. These are bribeable mercenaries that do whatever it takes for financial gains. You can find similar types of bribes in the Curve wars as well. There is a specific section for this on the Curve website that allows protocols to reward/bribe people that decide to vote for their pool. Because their vote would drive higher yields for their pool (win-win huh?). You can find this here. Imagine you want to earn Ren, then you would vote for their pool and receive their token instead. A nice tactical game playing out here.

Since we are on the topic of bribes, let’s take a look at the mafia protocol.

The Mafia protocol

“Say hello to my little friend”. The mafia protocol is what I call the protocol that has managed to acquire significant control over veCRV supply through sufficient bribes. The mafia protocol is a force of nature that is dominating the Curve wars. This protocol is none other than Convex Finance. The aim of Convex Finance is to accumulate as many veCRV tokens as possible through the locking of CRV. They have managed to do this through bribes. Convex has incentivized CRV holders to convert their CRV to cvxCRV and stake it on their platform.

This has enabled Convex to control the voting power of the converted CRV while still allowing people to receive the same benefit from holding veCRV which is yield accumulated from trading fees. However, cvxCRV can’t be converted back to CRV but it is tradeable on the market which gives you a backdoor exit. cvxCRV also incentivizes very favorable rewards. The rewards are roughly around ~58% APY APR that is paid out in CRV, CVX, and 3CRV which is lucrative bribe participants are willing to take.

So why is Convex Finance the mafia protocol? Because they have managed to amass as much as 51% of the veCRV supply which means that they essentially control the gauges on CRV. Utilizing their tokenomics to perfection. Since CVX is the token for Convex Finance, you can lock up this token to receive the governance token vlCVX in order to vote on proposals concerning veCRV. This has led to other protocols now partnering with Convex Finance for them to influence yields in other protocols' favor. Yearn Finance is one of them. Other protocols like Olympus have now started to acquire Convex Finance instead, understanding that influencing their governance will have a stronger effect than trying to acquire more CRV directly. Curve Wars squared.

Now, I won’t get into deeper details in regards to all protocols that are involved in the Curve Wars since this is already quite an extensive background. But with this understanding, we can now enter the Spirit Wars.

Enter the Spirit Wars

With the Curve Wars fully in motion on the Ethereum blockchain, the fighting spirit has now spread to Fantom as well. The protocol that is central to this battle is SpiritSwap. SpiritSwap is a DEX and an AMM on the Fantom blockchain. While Curve mainly focuses on stablecoins, SpiritSwap simply focuses on swapping one token for another and building out markets for token pairs. The native token on SpiritSwap is SPIRIT. It can be earned by people farming on the protocol and also be locked in for inSPIRIT, similar to how Curve is locked in for veCRV. The locking period can last from 1 week up to 4 years. The total supply of inSPIRIT is 1,000,000,000 tokens.

inSPIRIT is the governance token of Spiritswap and can be used to vote for on-farm emission allocations. These votes take place once a week and drive yields in a similar fashion to Curve. The governance token also allows you to earn fees for participating in the protocol along with boosted farming rewards.

Boosted SPIRIT farming rewards:

up to 2.5x in farming rewards

E.g. without inSPIRIT, you can farm FTM-SPIRIT for 100% APR. With sufficient inSPIRIT to achieve max boost, the APR of the same farm FTM-SPIRIT get boosted to 250%

As goes with good farming rewards, good bribes ensue as well. There is a protocol on the Fantom blockchain that is adopting the Mafia strategy and is trying to take control of the Spirit Wars aggressively. The one that is in control of inSPIRIT is subsequently in control of the gauges. This power can’t be overstated. I have mentioned previously how Convex Finance incentivized holders of CRV to convert it to cvxCRV. Well, tell me. What do we have here?

Baby Mafia Protocol

You know what they say: “Imitation is the sincerest form of flattery.” We have another protocol on the Fantom blockchain that is operating the same strategy as Convex Finance. This protocol is Liquid Driver which is a liquidity mining protocol. They enable you to stake LP tokens on their protocol and earn their native token LQDR as a reward. However, the Spirit Wars is in full effect as Liquid Driver is doing its best to accumulate inSPIRIT tokens to get voting power over the gauges. They are doing this through their own form of incentivization.

Liquid Driver is incentivizing inSPIRIT holders to convert it to linSPIRIT which is a wrapped version of the inSPIRIT token by Liquid Driver. Users that decide to convert their inSPIRIT to linSPIRIT can earn yields generated by SpiritSwap with a very generous APR which currently consists of 68%.

How effective has this strategy been? Well, Liquid Driver currently holds 30% of the inSpirit supply and is on its way to achieving what Convex Finance did. Other competitors are trying to chime in, as Grim Finance has created their own wrapped version of inSpirit as well. ginSpirit is the Grim Finance equivalent. However, since Grim Finance got exploited at the backend of last year, Liquid Driver has been pulling away substantially, which is completely understandable.

However, the Spirit Wars is not over yet since Liquid Driver has not acquired the same amount of control as Convex Finance did yet. Also, this war is cross-chain as Olympus is participating here as well. Olympus went and acquired CVX directly in the Curve Wars instead of CRV. In the Spirit Wars, Olympus decided to acquire SPIRIT directly and vote for their own pool in the gauges to drive more yield for their holders.

There is still room for growth in the Spirit Wars as it is still early. Nonetheless, new protocols entering this war will have to consider their strategy. Do they try to compete with Liquid Driver and try to accumulate as much SPIRIT as possible, even though they most likely won’t win? Or do they start accumulating LQDR early and start to vote in their governance proposal. Alternatively, relinquish their SPIRIT tokens for linSPIRIT and enter a partnership with Liquid Driver. This is possible through acquiring LQDR tokens and locking them up to receive xLQDR which is the governance token. It also enables you to receive yields on multiple farms through their revenue-sharing model. This gives you an APR of 93.72%

Different strategies enable different possibilities. What we do know is that the war is far from over. What do you think the outcome will be in the Spirit Wars?

Author’s Words

I want to clarify that even though I am a finance professional, this is not financial advice, and this article is only meant to bring light to the current market situation. I advise everybody to do their own research, I only want to help you to find what you are looking for. If you enjoyed this piece, feel free to share it and subscribe.